Portfolio Statement Footing

Total Investments

“Total Investments” is calculated by summing the raw “Market Value” for all securities on the “Fund Holdings” page.

“Total Investments” is never adjusted for footing. The footed value for “Total Investments” will always equal the rounded value and the rounding level is determined by the “Market Value” rounding setting on the “Calculations” tab of the “Portfolio Statement Templates” page.

Category Totals and individual security values

The footing logic begins adjusting footed numbers as needed to ensure that “Total Investments” foots correctly. The logic begins by footing category totals, beginning with the outermost level first to ensure that the values foot to “Total Investments”. The logic continues footing category totals until it reaches the underlying securities. From there, the footing logic adjusts individual security values to ensure the category totals foot correctly.

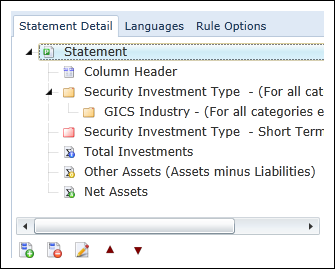

In the structure below, the footing logic will foot “Total Investments”, then “Security Investment Type” totals (outermost category types) and then “GICS Industry” totals.

The footing logic will always adjust the raw value with the least impact up or down (i.e., the value closest to “$0.50” for dollars, or “$500” for thousands). Individual securities or category totals can be adjusted to ensure the portfolio foots properly.

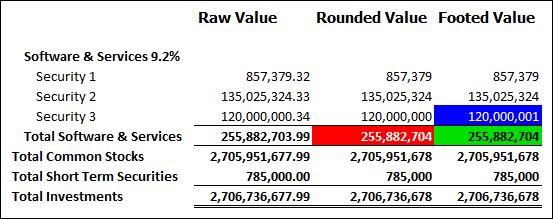

In the example below the logic first rounds all the raw values. This is represented in the “Rounded Value” column. The system will then begin footing the portfolio from “Total Investments” up. In this situation the “Total Investments” line, “Total Short Term Securities” and “Total Common Stocks” all foot to the underlying values (not shown). However, the “Total Software & Services” category does not foot (the value shown in red). Therefore, one of the underlying securities must be adjusted for footing. The “Security 3” raw value is closest to “$0.50” and is therefore adjusted up to “120,000,001” (the value shown in blue). The “Total Software & Services” category now foots properly (the value shown in green) and the footing logic stops.

Formulas

Formulas do not participate in the footing logic. Using the already-footed values, formulas simply display the summation of the values.

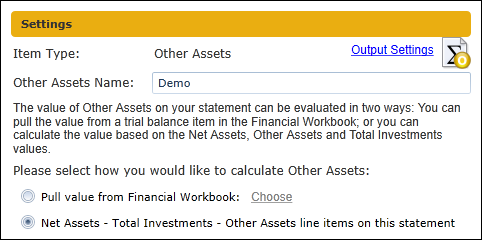

Other Assets

You can add one or more “Other Assets” line items. “Other Assets” can be calculated in one of two ways:

-

A value from the financial workbook

-

You can reference a value directly from a trial balance.

Calculation sheet values cannot be referenced because they will create a circular reference.

-

-

“Net Assets” minus “Total Investments” — minus all “Other Assets” line items.

- This value is a “plug” and will ensure that the portfolio values all foot correctly.

-

To ensure this plug is being calculated correctly, a proof can be set up in the financial workbook to double check the value.

One of the “Other Assets” line items or the “Net Assets” line item must have the “plug” option selected. This will ensure the portfolio will always foot.

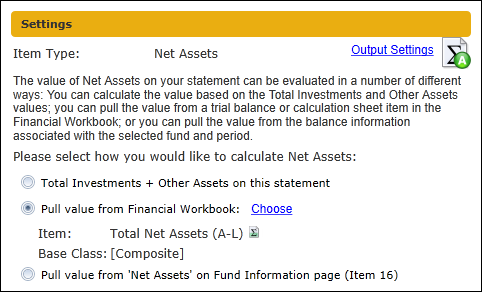

Net Assets

You can only add one “Net Assets” line item. “Net Assets” can be calculated in one of three ways:

-

“Total Investments” plus all “Other Assets”

- This value is a “plug” and will ensure that the portfolio values all foot correctly.

-

To ensure this plug is being calculated correctly, a proof can be set up in the financial workbook to double check the value.

The “Net Assets” line item or one of the “Other Assets” line items must have the “plug” option selected. This will ensure the portfolio will always foot. You will receive an error message on attempt to save when this is not the case.

-

A value from the financial workbook

-

You can reference a value directly from a trial balance, typically the “Net Assets (A-L)” or “Net Assets (Capital)” value.

Calculation sheet values cannot be referenced because they will create a circular reference.

-

-

Pull value from “Net Assets” on the “Fund Information” page (“Item A.16”).

- For ArcFiling: This is “Item A.16” on Form N-MFP. ArcFiling users will select this option.

-

For ArcReporting: This is the fund data point called “Net Assets”.

Typically you will use one of the other two “Net Assets” options.

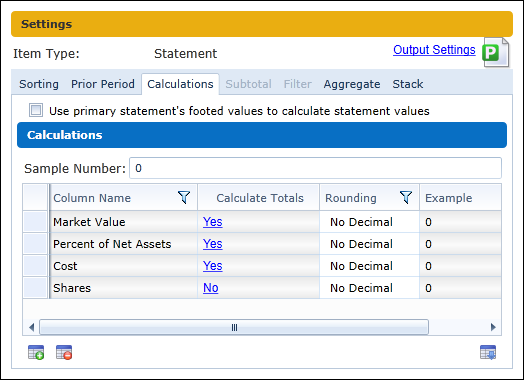

Other value fields such as “Percent of Net Assets”, “Cost”, “Shares”, etc. will foot in exactly the same way that “Market Value” foots in the example above. The footing engine is enabled for each field by adding it to the “Calculations” tab of the “Portfolio Statement Templates” page and setting the “Calculate Totals” value to “Yes”. If this value is set to “No” or if it’s not added to the grid, the values displayed will be the rounded values and the totals will display as “0” if shown in output.