Trial Balance Footing

Trial balance footing logic uses a bottom-up approach to calculate the correct “Total Net Assets (A-L)” and “Total Net Assets (Capital)” values.

Footed values for “Total Net Assets” will always equal the rounded values; these numbers are never adjusted for footing. From this point, the footing logic begins adjusting footed numbers as needed to ensure that “Total Net Assets” foots correctly. The logic begins by footing section totals (e.g., “Total Assets”, “Total Liabilities”, “Total Income”, “Total Expenses”, etc.) to ensure that the values foot to “Total Net Assets”. From there, the footing logic adjusts custom sub-section totals, then individual items to ensure that section totals foot correctly.

The footing logic will not adjust individual financial account values; only items, sub-section totals and section totals. The footing logic will always adjust the value with the least impact up or down (i.e., the value closest to “$0.50” for dollars, or “$500” for thousands).

Total Net Asset formulas

- Total Net Assets (A-L) = Total Assets - Total Liabilities

- Total Net Assets (Capital) = Total Equity + Total Realized Gain/Loss + Total Unrealized Gain/Loss + Total Income - Total Expenses

- Net Investment Income = Footed Total Income - Footed Total Expenses

- “Net Investment Income” is calculated last, and is always the result of (Footed Total Income - Footed Total Expenses). For example, if Total Expenses gets footed during Total Net Assets (Capital) footing, then that footed value will be used for Net Investment Income.

- “Memo Debit” and “Memo Credit” sections do not participate in the footing logic.

- The footing logic will work if entire sections are missing from the trial balance setup.

- The footing logic will work across multiple trial balances. For example, if “Assets” and “Liabilities” are not on the same trial balance, “Total Net Assets (A-L)” will still look to those values and foot them accordingly.

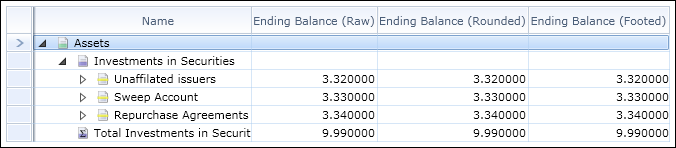

When viewing a trial balance via the “Financial Workbook” page, you may notice “Ending Balance (Footed)” values with blue background shading. This background shading is an indication that the value has been adjusted for footing by the footing logic.

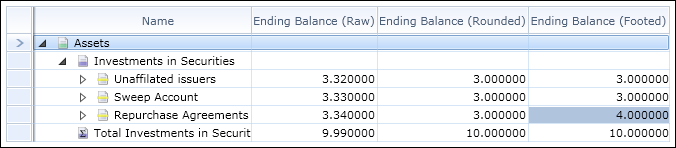

In the example below, the footing logic has adjusted the “Ending Balance (Footed)” value for “Repurchase Agreements” in order to create a valid footing situation, since its “Ending Balance (Raw)” value (“$3.34”) was closest to “$0.50” among the other items in the sub-section.

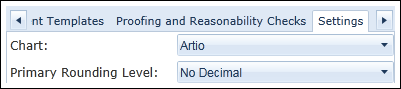

In the example above, the “Primary Rounding Level” setting for the financial workbook was set to “No Decimal” through its associated template. The “Financial Workbook Templates” page can be accessed via the corresponding item in the “Structure Templates” menu section on the “Administration” tab, or by clicking the link on the “Financial Workbook” page.

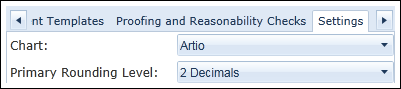

If the rounding for a workbook is set to another level, the footing logic will respect the setting. For example, if the rounding level is changed to “2 Decimals” for the workbook shown above…

… there is no need for the footing logic to adjust the “Repurchase Agreements” item, as before.